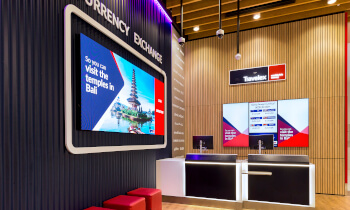

How do we compare? Every day we check the exchange rates of major banks and high street retailers and adjust our rates accordingly to ensure that we give you a highly competitive overall price on your foreign currency.

[BuysYouAmount] buys you:

- [name][amount]

Travelex.co.uk Price Promise

Find a cheaper overall price and we'll refund the difference. Terms apply. [hyperlink to terms popover]