Travel Money Card

The Travelex Money Card is the quick, easy and secure way to spend abroad

Travelex Money Card

- A safe way to carry and spend travel money abroad

- Load up to 15 currencies on your Travelex Money Card

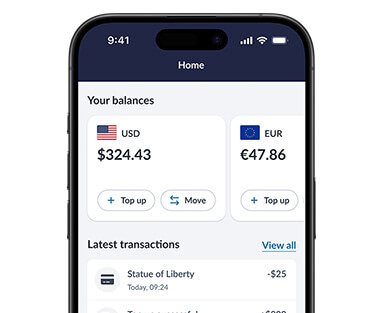

- Manage your balance 24/7 through the Travelex Money App

- No commission or hidden charges

- Freeze and unfreeze your card, reveal your PIN or other card details via the Travelex Money App

- Pay with confidence anywhere Mastercard Prepaid is accepted

Travel Money Card Benefits

Safe & Secure

Find the right balance for your trip

With our multi-currency prepaid card, you can reduce the amount of cash you need to carry on holiday and find the right balance for your trip. Plus, your card is not linked to your bank account, providing an extra layer of security against potential financial threats, and reducing the risk that comes with carrying cash.

Control at your fingertips

Manage your travel funds effortlessly with the Travelex Money App. Along with the essential features of freezing/unfreezing your card for enhanced security, the app provides seamless options to top up your card on-the-go. Always have secure access to your PIN and stay in full command of your travel money, ensuring a worry-free experience.

Peace of mind

Lock in your rates

No more fluctuating exchange rates causing stress during your travels. With our multi-currency prepaid card, you can lock in your exchange rates1, shielding your budget from unexpected currency fluctuations.

Free and secure cash access

Forget about ATM fees eating into your travel budget. Our card provides free cash access with no overseas ATM charges2, allowing you to withdraw funds wherever you are. And in case your card is lost, stolen, or damaged, our 24/7 global assistance team is here for you. We aim to replace your card swiftly or provide emergency cash to keep your journey on track.

Easy to use

Effortless transactions

Experience the ease of secure contactless payments – no signature or PIN required. Streamline your transactions and enjoy the convenience of a smooth payment process at millions of locations worldwide, wherever Mastercard Prepaid is accepted.

Easy money management

Enhance your travel experience with the flexibility to top up in 22 different currencies, including EUR, USD and AUD, and the convenience of transferring funds between your currency wallets in our app all through one versatile card, making international spending more seamless and efficient.

Seamless spending

You can easily add our card to your Apple Pay or Google Pay Wallet, making your payments smooth frictionless.

Upgrade your travel money.

Join Travelex Plus for free and get a first trip discount valid for 30 days. Plus, exclusive members-only sales, 0% commission however you buy, and get alerted when our rates are at their best and we even freeze them for you until the next day.

How does a Travelex Money Card work?

It’s fast and easy to get a Travelex Money Card.

Currencies and Rates

Explore the 22 currencies available to you on our prepaid travel card.

Fees and Limits

Free ATM withdrawals worldwide

Access your money without the hassle of ATM fees2, whether you're in the UK or exploring abroad.

Free replacement card

Enjoy peace of mind with our free replacement card service, available if your card is lost, stolen, or damaged while you're away or access to emergency cash.

Low minimum load/top-up

Get started with a minimum load of just £50.00 GBP.

Generous spending limits

Spend up to £3,000.00 GBP at retailers and merchants within a 24-hour period.

|

Fees

|

|

|---|---|

|

Fee type

|

Fee

|

|

Load/Top-up fee – foreign currency wallets

|

Free

|

|

No fee charged when you top up regardless of payment method. Like a commission fee. |

|

|

Load/Top-up fee – Pound

Sterling wallet

|

2%

|

|

Fee charged when you top up regardless of payment method. Like a commission fee. |

|

|

Additional card fee

|

£5.00 GBP

|

|

Fee charged for getting a backup card, where available. |

|

|

Currency transfer fee

|

Free

|

|

No fee for moving money between wallets. Foreign exchange rate applies, varies each day. |

|

|

Fee for paying with the card

(international)

|

Free

|

|

No fee for paying with your card outside the UK, whether at retailers or online. Some retailers may charge their own fee. |

|

|

Fee for paying with the card

(UK)

|

Free

|

|

No fee for paying with your card in the UK, whether at retailers or online. Some retailers may charge their own fee. |

|

|

Fee for ATM withdrawals

(international)

|

Free

|

|

No fee for withdrawing cash at an ATM outside the UK. Some operators may charge their own fee. |

|

|

Fee for ATM withdrawals (UK)

|

Free

|

|

No fee for withdrawing cash at an ATM in the UK. Some operators may charge their own fee. |

|

|

Cash over the counter fee

|

Free

|

|

Fee for withdrawing cash over the counter (for example, in a bank). They may charge their own fee. |

|

|

Cash out fee at a store

|

Check in store

|

|

Fee for cashing out your card before the card expires, or after a period of 12 months after the expiry date. |

|

|

Cash out fee by calling Card

Services

|

£6.00 GBP

|

|

Fee for cashing out your card before the card expires, or after a period of 12 months after the expiry date. |

|

|

Inactivity fee

|

£2.00 GBP per month

|

|

Fee charged after a 12-month period of you not using your card (either by topping up your card, paying for transactions or withdrawing money), including after your card has expired. No fee if you have a zero balance. |

|

|

Foreign exchange fee

|

5.75%

|

|

Fee for using your card for a transaction in a currency which is not available on your card or you don’t have enough balance in the transaction currency and the rest is taken from another currency wallet. Check how our foreign exchange rates compare to the European Central Bank rates. |

|

|

Shortfall fee

|

£10.00 GBP

|

|

Fee charged if a payment takes your balance below zero. |

|

|

Replacement card

|

Free

|

|

Free service to send you a new plastic card whilst you are away if you lose your card, or it is stolen or damaged, where this service is available. |

|

|

Limits

|

|

|---|---|

|

Limit type

|

Limit

|

|

Minimum amount you

can load or top up (in store, online and on the Travelex Money app)

|

£50.00 GBP

|

|

Maximum amount you

can withdraw in 24 hours over the counter, i.e. at a bank

|

£150.00 GBP

|

|

Maximum amount you

can withdraw from an ATM in 24 hours

|

£500.00 GBP

|

|

Maximum amount you

can spend at retailers/merchants in 24 hours

|

£3,000.00 GBP

|

|

Maximum amount you

can have on your card at any one time

|

£5,000.00 GBP

|

|

Maximum amount you

can load in total in a 12-month period

|

£30,000.00 GBP

|

|

Maximum number of

active card accounts you may have at any one time

|

1

|

|

Card lifespan

|

See card for expiry date

|

|

Maximum number of

attempts when entering your PIN

|

3 in each 24-hour period

|

With set fees and limits our Travelex Money Card is your perfect travel companion.

Download the Travelex Money App

- Top-up your Travelex Money Card in a flash

- Manage your money on the move

- View your latest transactions and track your spending

- Instantly freeze your card to protect your account

What our customers say

Find out why our community trust in Travelex

Common questions about the Travelex Money Card

A travel money card (sometimes referred to as a prepaid currency card) is a global multi-currency card that’s not linked to a bank account. Like a debit or credit card, travel money cards can be used to make purchases in stores, online, and to withdraw cash at ATMs while travelling.

Some providers may charge you for using your card abroad, but we do not charge spending fees3 on our Travelex Money Card.

You can get a Travelex Money Card by purchasing currency online or in-store. Find our full list of stores here.

You can use the Travelex Money Card in most countries across the world, wherever Mastercard Prepaid is accepted. Choose from 22 available currencies: British pounds, euros, US dollars, Australian dollars, Canadian dollars, New Zealand dollars, South African rand, Turkish lira, Swiss franc, UAE dirham, Mexican peso, Polish zloty, Czech koruna, Swedish krona, Japanese yen, Thai Baht, Hong Kong dollars, Singapore dollars, Danish kroner, Norwegian krone, Hungarian forint and Icelandic krona.

Like most bank accounts, you can withdraw money from your travel money card at ATMs worldwide. The maximum withdrawal amount is 500.00 GBP within a 24-hour period. Please bear in mind Travelex does not charge ATM fees but some operators may do so, check before you withdraw cash. Travelex Money Card T&Cs can be found here.

Still have questions?

Explore our support categories for more help.

The basics

Basic information about the Travelex Money Card.

Getting started

Details on obtaining and eligibility for the card.

My account

Managing your Travelex Money Card account.

Managing card

PIN, balance checks, and card management.

Using & topping up card

Card usage, currencies, and transaction limits.

Apple pay

Details about adding your card to an Apple Wallet.

Google pay

Details about adding your card to a Google Wallet.

Fees and limits

Information on fees and limits.

Getting help

Support for lost/stolen cards and troubleshooting.

Previous cards

Information for Cash Passport customers.

- Travelex Money Card Terms & Conditions can be found here.

- 1 Lock in your exchange rates mean the exchange rate is locked in for the initial load only. The exchange rates for subsequent reloads will be set at the prevailing exchange rate at the time of the transaction.

- 2 Although Travelex does not charge ATM fees, some operators may charge their own fee or set their own limits. We advise to check with the ATM operator before using.

- 3 No charges when you spend abroad using an available balance of a local currency supported by the Travelex Money Card.

- Travelex Money Card is issued by PrePay Technologies Limited pursuant to license by Mastercard International.

- PrePay Technologies Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money and payment instruments. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

- Apple and the Apple logo are trademarks of Apple Inc. registered in the U.S. and other countries. App Store is a service of Apple Inc. registered in the U.S. and other countries. Google Play and the Google Play logo are trademarks of Google LLC.